TUESDAY, 04 OCTOBER 2022

Rental and sales market update: London sees the highest growth since 2015

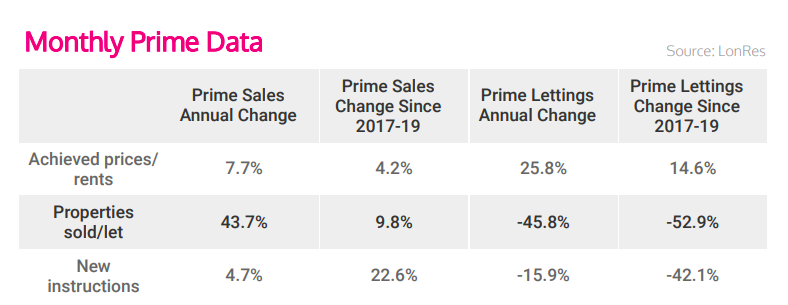

The latest update on the prime London property market reveals some positive news for vendors and investors, as summer sales figures show a significant rise above pre-pandemic levels.

In the lettings sector, a shortage of housing stock is driving up rental costs. Figures for July show that year-on-year, the number of new lets was down by 45 per cent.

Rising interest rates, combined with increases in the cost of living, have caused considerable anxiety for homebuyers and renters in the past few months. But in spite of these wider economic concerns, the central London property market has remained remarkably resilient.

What’s happening to Prime Central London property prices?

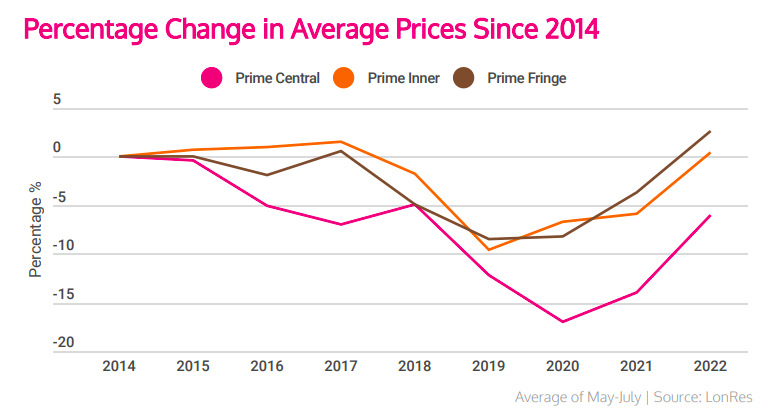

In July, London property sales were 9.8 per cent higher than average figures for 2017-19, with prices rising by 4.2 per cent. This represents the highest growth since January 2015. The chart below shows the change in average prices for Prime Central, Prime Inner and Prime Fringe sectors since 2014.

The years prior to the pandemic (2017-2019) saw demand for London properties fall away, and this resulted in a drop in average house prices. However, the introduction of the Stamp Duty Holiday in late 2020 kickstarted a reversal in fortunes for the capital’s property market.

Although the end of the Stamp Duty discount in September 2021 caused a brief lull in sales activity for properties under £5m, growth remained strong at the top end of the market.

Over the past year, demand has continued to grow and this has resulted in a 43 per cent increase in the number of properties sold (compared with 2021 figures). This dramatic upswing is partly due to the return of overseas buyers, keen to enjoy the extra value offered by a weakening pound. It also reflects the fact that many homeowners who left the capital during the pandemic have now moved back to London.

What can we learn from current London house price trends?

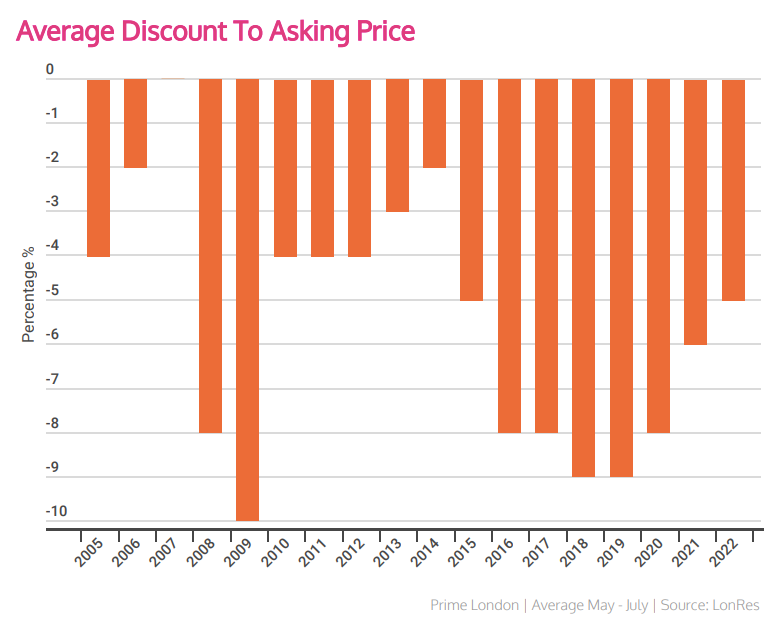

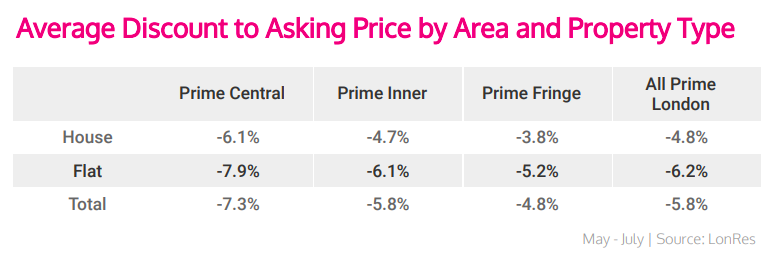

Recent property market growth has impacted the average discount to asking price. Buyers can no longer expect the discounts of up to 10 per cent they enjoyed in 2018/19. Instead, they are currently settling for an average asking price reduction of around 5.8 per cent.

This shows a closer alignment of buyer and seller expectations. Sellers no longer insist on listing their properties at prices achieved at the top of the market, while buyers understand that low offers are less likely to be accepted.

The charts below illustrate the average discount to asking price, by year and property type.

How has the London rental housing market been affected?

Lonres, the data platform for property professionals, has reported that figures for new instructions, under offers and new lets fell well below normal over the summer months.

One of the greatest issues facing the London lettings market is the lack of available rental property, and this shortage has been compounded by the current economic uncertainty. Existing tenants, wary of rising rents, are choosing to save money by renewing their tenancies instead of moving on.

As a result, new applicants are forced to compete for the few remaining rental properties and consequently face tougher tenancy terms and higher rents.

Autumn is traditionally a busy time for the lettings market. Still, the imbalance between supply and demand could have a negative effect on the growth in activity normally seen during this period. Landlords entering the market or expanding their portfolios at this time can look forward to high rental yields and strong demand from tenants.

How can I find the best deal this autumn?

Whether renting or buying a property in London, you will benefit from getting the right advice. As leading estate agents in Central London, we specialise in luxury properties that make great homes and attractive property investments. Whether you are looking for a high-quality, new build apartment or a traditional townhouse, why let our expert sales team take care of the search?